Harnessing the DRE Potential: A Budget in Transition

Harnessing the DRE Potential: A Budget in Transition

The Union Budget presented by the Hon’ble Finance Minister on Feb. 1, has put a spotlight on building an Atma Nirbhar Bharat. For this, the Decentralized Renewable Energy (DRE) sector is a key enabler, given that deployment of DRE technologies has shown multifaceted advantages in providing better health and wellbeing, access to quality education, alleviation of poverty, creation of new employment opportunities, access to clean water and sanitation, apart from clean and affordable energy for all. Given the vast expanse of applications and related benefits, the use of DRE technologies also helps in contributing towards achievement of the SDGs and has been identified as a key sector which will help in the fulfillment of NDCs pledged by India under the Paris Agreement.

DRE technology, as a solution, has the capability to not only ensure availability of affordable clean energy for households and MSME businesses but has emerged as a supporter of rural livelihood activities, thereby helping the poor and marginalized strata of society generate higher disposable incomes. The idea that DRE technologies can only be used for lighting up rural households is now a thing of the past. Lighting and solar home systems remain one of the fastest moving DRE products till date, however solar powered applications such as pumps, cook stoves, cold storages and charging stations are steadily gaining popularity amongst business owners and entrepreneurs. Through the Union Budget, the government has tried to lay emphasis on the importance of self-sufficiency and provide incentives to help chart a roadmap for inclusive recovery post Covid-19.

Most industry stakeholders have hailed the provisions made by the GOI to uplift the RE sector as part of the Union Budget 2021-22. It has generally been considered an inclusive budget, especially in light of the Covid-19 pandemic as the government has allocated capital to the tune of INR 200 Billion to support integrated solar PV manufacturing and honor financial commitments of INR 1 lac crore per year to achieve RE capacity addition targets set by the country for 2022 and 2030. Through this, the government has not only asserted its seriousness towards the Paris Agreement but also has prioritized the concept of ‘Build Back Better’. The budget calls for an increase in import duty on solar lanterns (from 5% to 15%) and solar inverters (from 5% to 20%) which seems to be a move to encourage development of size and scale in domestic PV manufacturing facilities, given the INR 4500 Crore commitment made by the govt. towards high efficiency solar PV modules to be implemented by MNRE. These production linked incentive (PLI) schemes rolled out by GOI are expected to lead to the creation of import substitutes and encourage allied industrial activity including technological development. However, preference will be given to manufacturers who invest in an integrated solar PV manufacturing plant of high capacity. Thus, the direct benefit of these schemes to SME is not apparent at the moment.

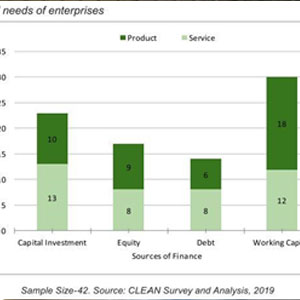

A recent survey conducted by CLEAN with its members to gauge their sentiments on the Union Budget indicated a mixed reaction. Members feel that an increase in import duty on solar lanterns and solar inverters will be ‘somewhat advantageous’ as the same is likely to result in an increase of 10%-30% in the production costs in the medium term. While members have given a ‘thumbs up’ to INR 4500 crore allocation to MNRE for production of high efficiency solar PV modules, implications of allocations to SECI have received mixed reactions. The MNRE draft policy framework for Developing and Promoting DRE Livelihood Applications in Rural Areas in Oct’20 focuses specifically towards the scaling up of DRE livelihood applications- however the same is yet to be finalized. It is evident that the DRE sector has immense potential to support livelihoods and pave the way for holistic economic recovery. A specific allocation for the DRE sector in next year’s Budget will support appropriate capital allocation towards the sector, as a specific focus sub-sector of the larger RE sector. CLEAN envisages the requirement of technology awareness interventions within the DRE sector for promotion, development and adoption of new technologies in the manufacture of high efficiency solar modules- since several new and cutting-edge technologies are being promoted by the Govt., mentioned as part of the Union Budget. The DRE sector has witnessed new technical innovations and emergence of novel businesses during the past couple of years. Creation of awareness about these developments amongst DRE stakeholders is very important since it will encourage greater deployment of DRE based applications.

Though the large financial allocations, such as those planned for SECI, appear exciting- a lot will depend on how and to which sub sectors the government/SECI will choose to facilitate capital flow (INR 12000 crores). At this point, one is only left pondering upon the vast benefits of a direct allocation of funds towards the DRE sector will have. Impact at the grassroots will only be determined once a detailed phased plan for domestic manufacturing is released, especially since the Budget calls for an increase in import duty. The mere availability of clean, affordable and reliable power has the potential to benefit rural households via creation of new livelihood opportunities, improve productivity and product quality and reduce wastage. In light of crises arising out of an unprecedented pandemic, with the right impetus, DRE technologies can help support rural livelihoods and instill a much-needed resilience in the Indian economy, emerging as a true champion in the larger RE sector. But whether the government shall be able to create a conducive and enabling environment for the upliftment of this sector, remains to be seen.

Written by: Kritika Kumar

Works as an Asst. Manager-Finance at CLEAN and can be reached at

Posts Comments (0)

Write a Comment

We’ll not publish your email address. Required fields are marked with *