Innovative financing for DRE

Innovative financing for DRE sector enterprises: Challenges and Solutions

DRE enterprises comprises product development/manufacturers as well as service providers/system integrators. There are diverse DRE solutions developed and provided by DRE practitioners and enterprises. Some of the prominent solutions include the following:

- Solar energy products and services like Lanterns, Home Systems, Micro/Mini Grids, Pumpsets, Solar Powered Agri Processing machines, Solar thermal applications etc

- Bioenergy - Biogas plants, Biomass gasifiers/microgrids, Improved Cookstoves (household and commercial), Waste to Energy plants etc.

- Hydro - Pico turbines/water mills, power plants

- Wind - Pico turbines, power plants and systems.

- Hybrid systems (solar-wind, solar-biomass etc.)

The Challenge

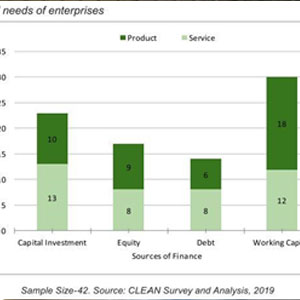

Working capital has been the major source of finance required by DRE enterprises. It has been reported that both debt and equity have stood out as major sources of financing in the past and are expected to continue doing the same in the future as well. However, there is an increasing interest to access finance through Impact funds, Corporate Social Responsibility (CSR) funds, Grants, and Micro Finance Institutions (MFIs).DRE enterprises strive to serve the unserved and under-served population of India. For strategic deployment of technology, it is important to first understand the paying capacity of the end users.

The DRE sector has constantly expressed the need to provide appropriate technology and affordable, innovative financing to the end users. A good mix with DRE will support productive use and augment incomes. Challenges around financing mainly involve lack of innovative financing and financier capacity building.

As per CLEANs State of DRE Sector in India report for 2019, most organisations that were at the initial level of operations were self- funded. Those who did manage to get loans in the initial phase could only get them for a short term. According to the report findings, challenges that emerged included limited end-user financing, lack of outreach of financial institutions in specific regions, and lack of awareness of financial institutions about the various DRE applications.

The Solution:

To mitigate the challenges cited and in order to ensure a satisfactory end-user experience, it is important to create an ecosystem where service providers reach out to the end users with the suitable offerings. The financial institutions and DRE enterprises must take the following important measures:

- Affordable financing - Innovative financial products by financial institutions are the need of the hour considering the existing repayment period and the collateral amount. The enterprises and the end users also need to explore the existing financial products and avail loans that suit their needs.

- Sensitization of Financial Institutions - The financial institutions are unaware about various new DRE applications available in the market. There is a need to sensitize them about new technologies, working process, merits and its impact on the general public. This will help them in designing new financial products to support such technologies.

- Appropriate technology - The needs of the people cannot be standardised and enterprises need to realize this and design products accordingly. There are two critical points here, one is the need and the other is affordability. This requires a rigorous need assessment and last mile innovation in the product combination.

- Door-step services and maintenance - Good after-sales service and maintenance determines the life of the solution provided and decides the sustainability of the business model. This will also contribute in proper financing of the product and help the beneficiaries in the repayment process.

The financial institutions look forward to the enterprises charging less margin on the products so that the cost of the DRE products can be reduced for the unserved & underserved population of India. They also require support from government and enterprises or third parties in the form of subsidy and guarantee funds so that the burden of risk can be shared among the stakeholders. There should be a quick and effective after-sales service by the enterprises which will ensure regular income generation by the beneficiary and reduce the rate of delinquency. On the other hand, the enterprises need financial support from the financial institutions in the form of collateral free loans and reduced rate of interest. There is a need for patient investors because the outcome can be observed after a few years of installation. The enterprises are expecting some innovative financial products which support DRE applications and there is a need to sensitize financiers about new technologies for this purpose. CLEAN feels that there is a strong need for close coordination between the DRE enterprises and financial institutions to develop a sustainable business environment for the sector.

Written by: Juhi Anand

Associate – Access to Finance

Posts Comments (0)

Write a Comment

We’ll not publish your email address. Required fields are marked with *